- #HOME APPRAISAL CHECKLIST SEATTLE CODE#

- #HOME APPRAISAL CHECKLIST SEATTLE PROFESSIONAL#

Declutter surface areas – Trash it, organize it, or sell it-there’s no wrong way to get rid of stuff.Another step to prepping your house is something the whole family can participate in: a nice, deep clean! A well-maintained home appears more valuable than one that isn’t. You’ve already tackled your time-consuming repairs.

In short, any damage can potentially bring down your home’s appraised value and will lessen the chances of selling to a potential buyer.

Unregulated temperatures, like dampness. #HOME APPRAISAL CHECKLIST SEATTLE CODE#

Plumbing or electrical fixtures that aren’t up to code.

When an appraiser conducts home appraisals, an appraiser may list conditions that need to be inspected by an expert, including things like: Did you know that your home’s value may be affected by things that might lead to problems, even if they aren’t full-blown issues yet? Now that your squeaky door and scuffed wall are fixed, it’s time to turn a critical eye on potential red flags.

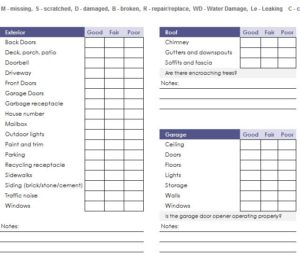

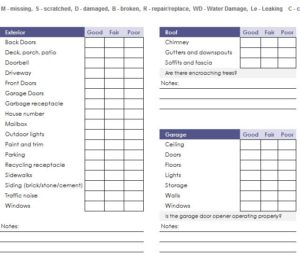

Replacing old carpet or other floorings. Investing in landscaping services or enhancing the curb appeal yourself. Repainting rooms if the color has faded, especially the home’s exterior. Repairing any glaring problems, like damaged drywall. Time to get out that toolbox!Įnsure your home appraisal checklist includes: Upgrades and improvements, such as types of flooring, countertops, and appliancesĪ home’s worth is typically valued in increments of $500, such as $130,000, $130,500, and so on, meaning that minor home improvements can mean major big bucks. Number of bedrooms, bathrooms, and fireplaces. Quality and condition of the roof, foundation, landscaping, plumbing, and lighting. Though the appraiser won’t check whether the outlets work, home appraisers often note other general features in their performance review.Ĭommon home appraisal value factors include: Your appraiser will use a designated form, almost like a home appraisal checklist, written and approved by a lender when she performs an inspection. The appraiser will submit the written appraisal to the lender about three to five days afterward. When it’s officially appraisal day, clear your schedule: the process can take anywhere from 20 minutes to a few hours. This should occur near the closing date since marketing conditions can change over a handful of months. If you’re selling your home, the buyer and their bank will schedule the appraisal. The borrower is typically responsible for this cost, so if you’re applying for a loan, you’ll need to cover this fee yourself. The reason for the range can be anything from the size of the property to the appraisal process itself, to its location. Home appraisal prices average $340 in the United States, though it can vary from about $200 to $600. If you’re interested in applying for a mortgage or home equity loan, the home appraiser sends the appraisal report to the lender. If you’re selling your home to non-cash home buyers, you’ll need an inspection and an appraisal. If you’re applying for a cash-out refinance, a home equity loan, or another way to leverage your equity, you’ll need an appraisal. A home appraiser determines its market value with a home appraisal checklist based on the prices of comparable homes. A home inspector reports your home’s condition. Know that a home inspection and a home appraisal are different and that one cannot replace the other. Home appraisal – Estimates a property’s home value for lenders and determines a fair price that buyers should be willing to pay. Home inspection – Gives a prospective buyer detailed information about the home’s condition (including its structure and construction), a list of things that may need to be fixed, and an estimate of the home’s longevity. #HOME APPRAISAL CHECKLIST SEATTLE PROFESSIONAL#

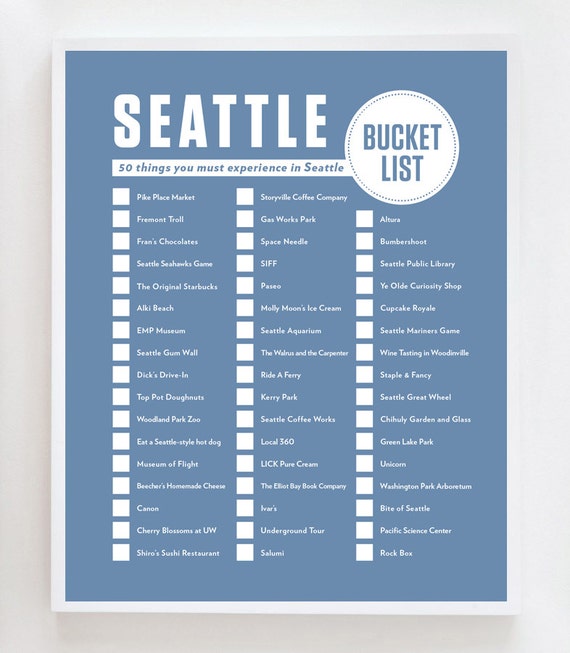

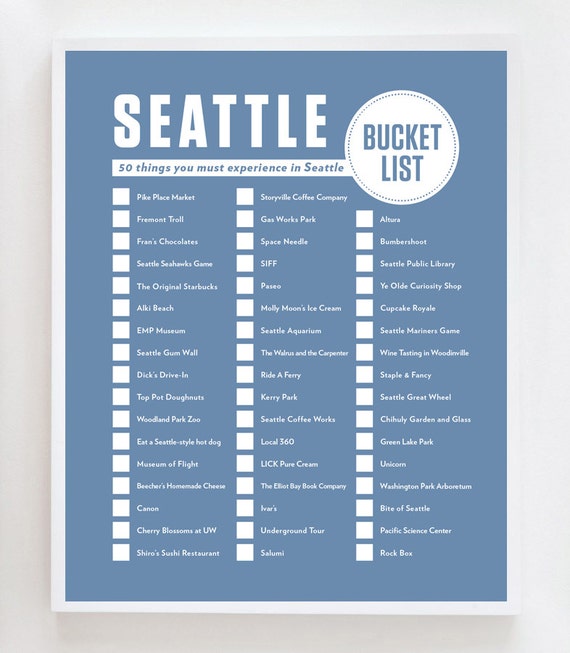

Learn the Difference Between an Inspection and an AppraisalĪ home inspection and a home appraisal are not the same things in real estate, but they are often confused because a professional visits a home and inspects it in both scenarios. To get a favorable appraisal report, use this home appraisal checklist to ensure you’re getting the maximum value for that white picket fence. Getting appraised is necessary when applying for a home equity loan or a home equity loan alternative. If you want to use your equity to pay off debt, purchase a new home, or fund a business, the first step is getting a home appraisal. The appraisal, an independent assessment of your house’s worth, describes what’s valuable about your home and compares it to similar properties in the neighborhood. Are you a homeowner? Lucky you: you’ve got equity! Equity is the amount of the home’s value that you own, equal to the home’s appraised value minus any outstanding debts.

0 kommentar(er)

0 kommentar(er)